closed end credit disclosures

Closed end credit is different because it doesnt allow you to continue using the same credit over and over. The disclosures required by this subpart may be provided to the consumer in.

Appendix A To Part 1013 Model Forms Consumer Financial Protection Bureau

Subpart C - Closed-End Credit 102617 General disclosure requirements.

. Disclosures under 10269c2vi. A The following disclosures need not be written. 102636 Prohibited acts or practices and certain requirements for credit secured by a dwelling.

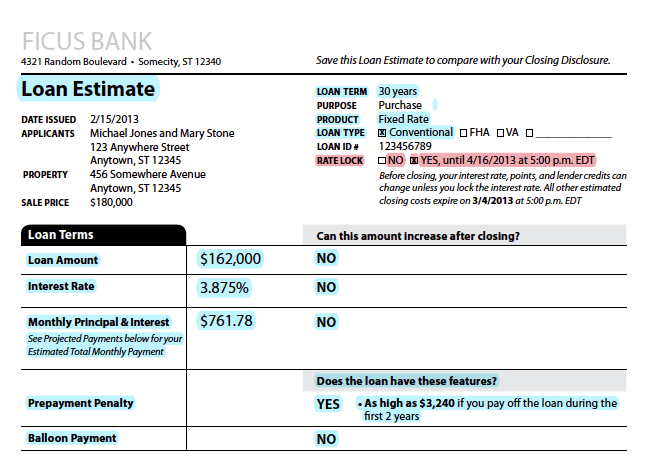

102637 Content of disclosures for certain mortgage transactions Loan Estimate. Creditors may use the model credit insurance disclosures only if the debt cancellation coverage constitutes insurance under. Disclosures under 10269d when a finance charge is.

If disclosures are delayed until conversion and the closed-end transaction has a variable-rate feature disclosures should be based on the rate in effect at the time of conversion. For a closed-end transaction not subject to section 102619e and f determine whether the disclosures are accurately completed and include the following disclosures as applicable. Closed-end credit such as an installment loan or auto loan is for a specific dollar.

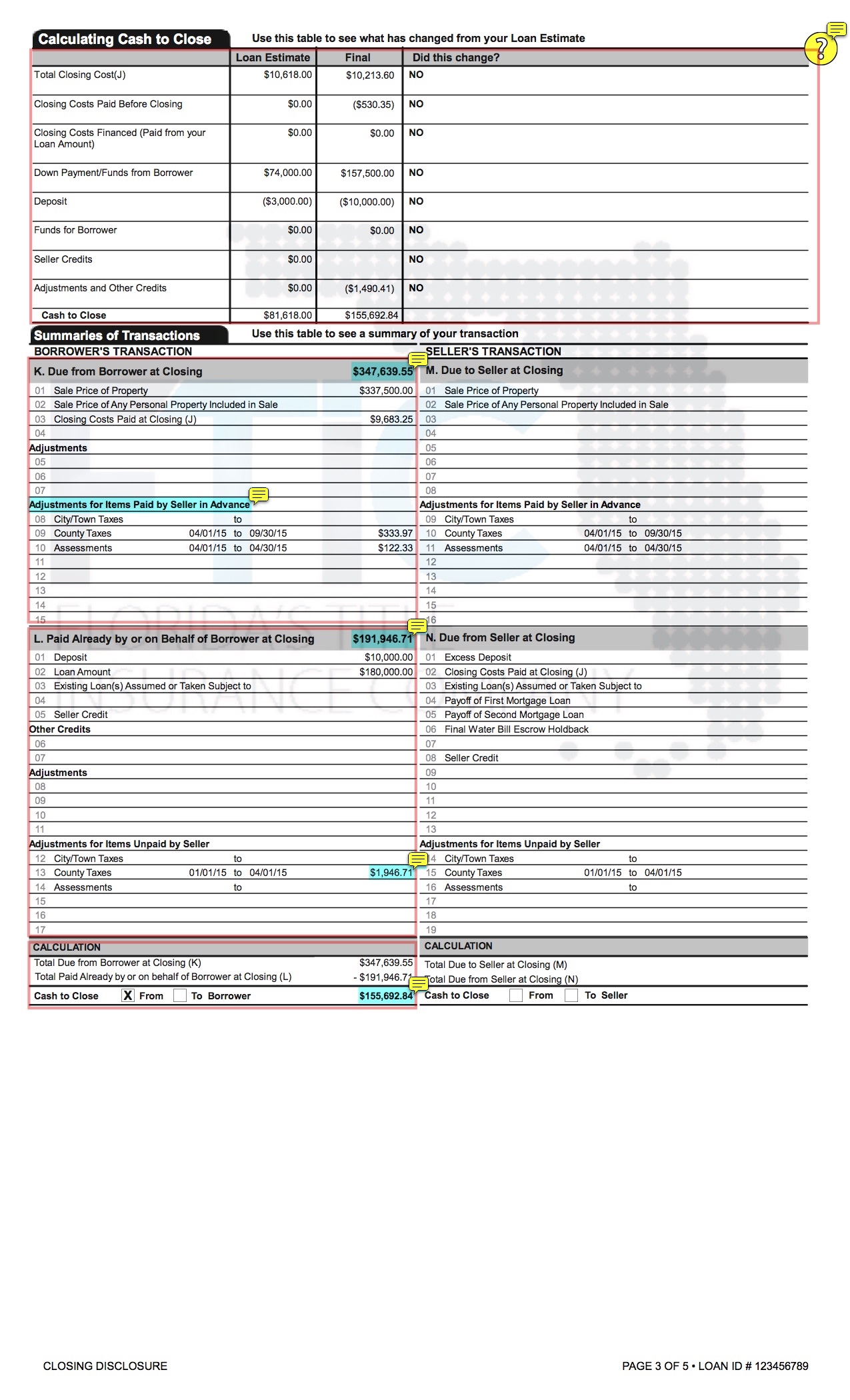

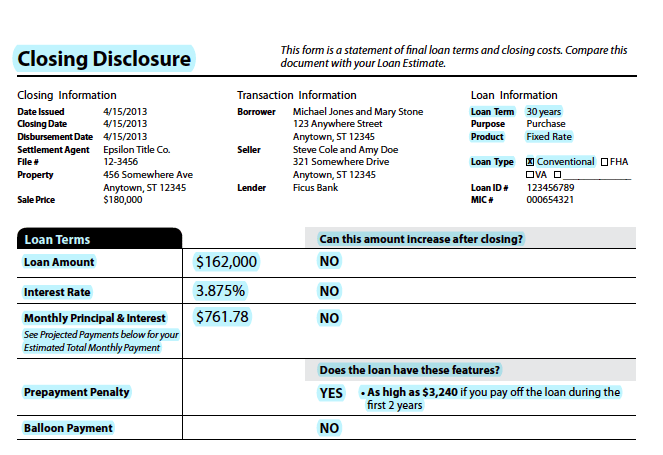

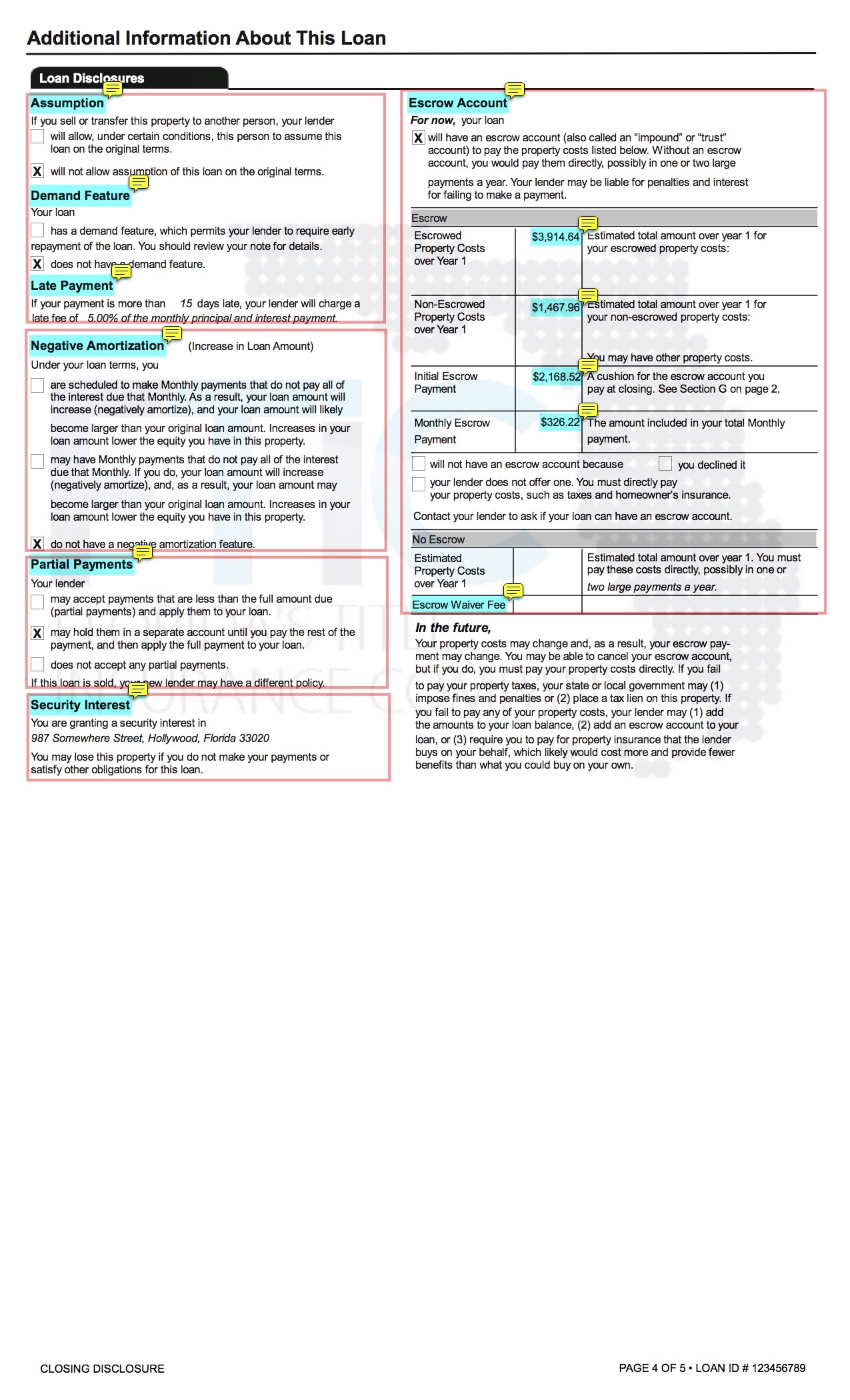

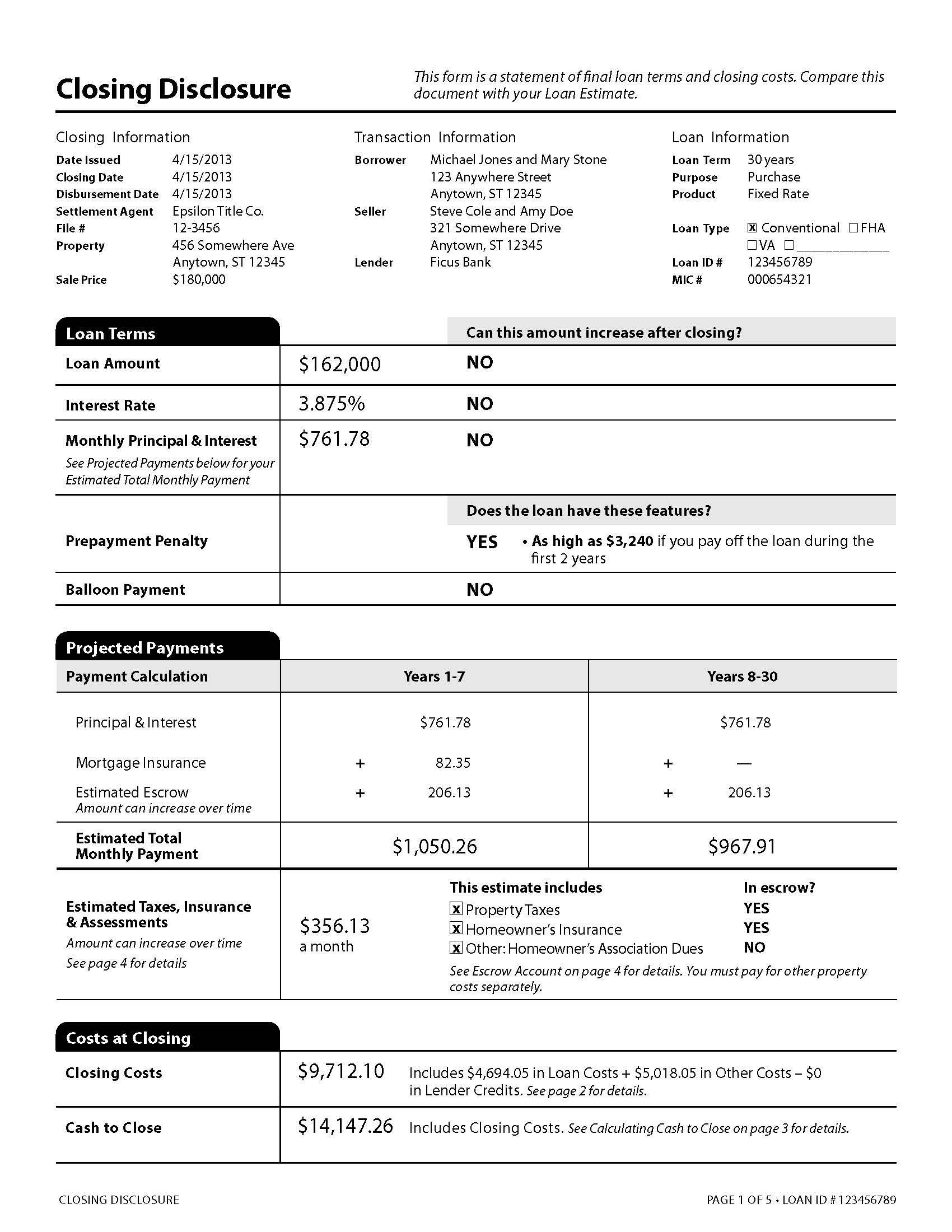

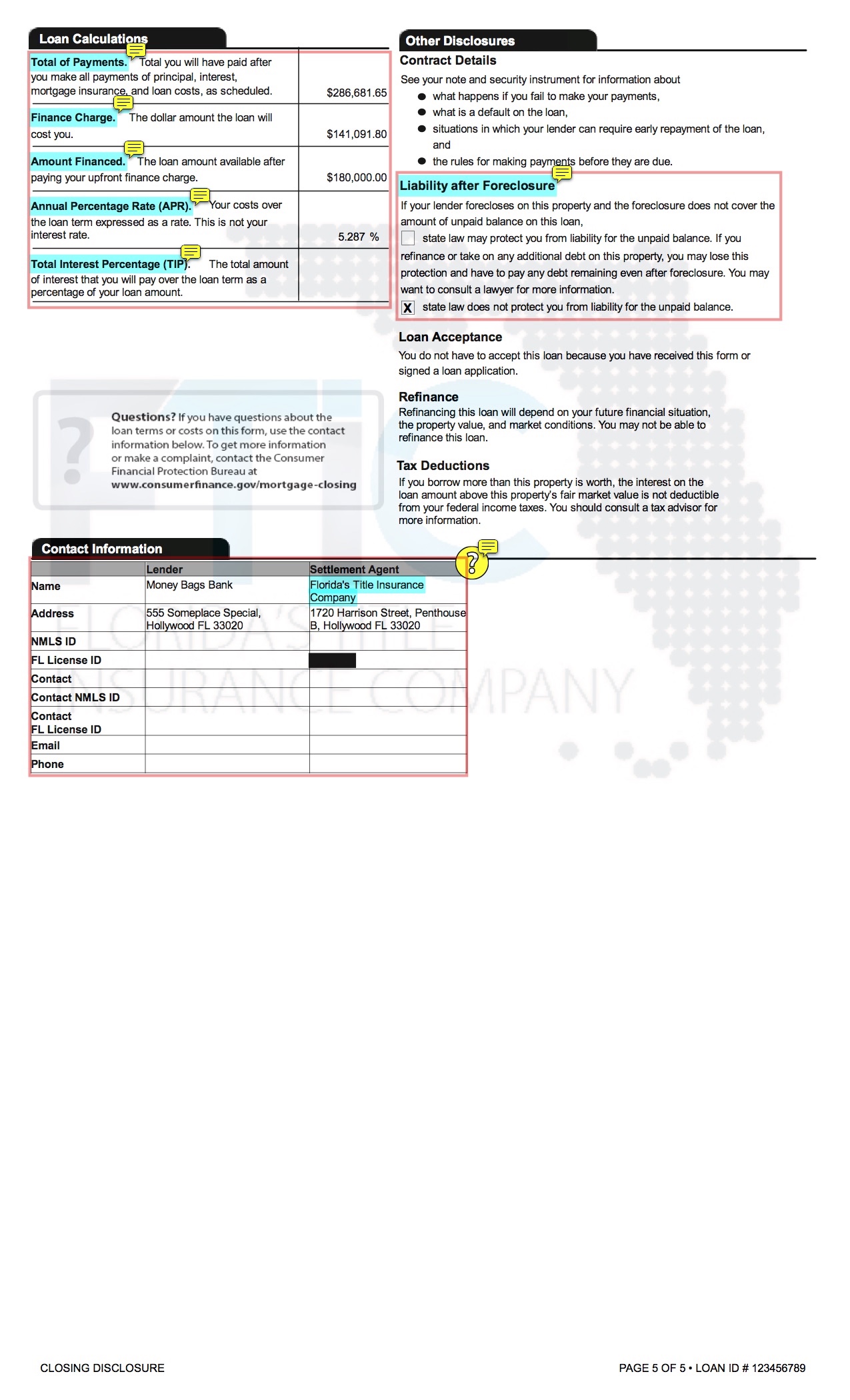

Model form H-29 contains the disclosures for the cancellation of an escrow account established in connection with a closed-end transaction secured by a first lien on real property or a dwelling. Creditors may provide a disclosure that refers to debt cancellation or debt suspension coverage whether or not the coverage is considered insurance. This is a sample of the information required on the Closing Disclosure by 102638j for disclosure of consumer funds from a simultaneous second-lien credit transaction not otherwise disclosed pursuant to 102638j2iii or iv that is used to finance part of the purchase price of the property subject to the transaction.

Disclosures under 10266b3 of charges that are imposed as part of an open-end not home-secured plan that are not required to be disclosed under 10266b2 and related disclosures of charges under 10269c2iiiB. 12202013 General Policy Statement. A closed-end credit agreement generally includes a payment schedule that defines the number of payments a borrower is expected to make over the life of the loan.

Closed-end credit allows you to borrow a specific amount of money for a finite term. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was established in connection with the transaction and will be cancelled the creditor or servicer shall disclose the information specified in paragraph e2 of this section in accordance with the form. 2The creditor may impose a finance charge from time to time on an outstanding unpaid balance.

Truth-in-Lending Disclosures for Closed-End Credit Revised Date. Open-end credit is defined as credit extended under a plan in which. 102618 Content of disclosures.

Sub-sections a and b cover all types of closed end transactions and then the various following subsections have specific requirements for credit sales for consumer loans for mail or telephone transactions etc etc. Section 102619e and f applies to closed-end consumer credit transactions that are secured by real property or a cooperative unit other than reverse mortgages subject to 102633. Closed End Credit is defined 2262 as credit other than open-end credit.

102639 Mortgage transfer disclosures. So what is closed-end credit. In a closed-end consumer credit transaction secured by a first lien on real property or a dwelling other than a reverse mortgage subject to 102633 for which an escrow account was established in connection with the transaction and will be cancelled the creditor or servicer shall disclose the information specified in paragraph e2 of this section in accordance with the form.

A closed-end line of credit must be repaid at a predetermined point while an open-end line of. A closed-end credit agreement may include a specific term or repayment schedule. By contrast open-end credit is revolving credit like a credit card that enables you to borrow repeatedly with no specified repayment date.

This model form illustrates the disclosures required by 102620e. There are two basic kinds of lines of credit. Banks credit unions and private lenders may offer closed-end credit products including all types of personal loans.

Examples of closed-end credit include personal loans auto loans and mortgages. With closed end credit when you originally apply for a loan with the lender the terms never change. The identity of the creditor making the disclosures.

1The creditor reasonably contemplates repeated transactions. As mentioned earlier closed-end credit must be repaid in full by a predetermined date also known as the loan maturity date. If consummation of the closed-end transaction occurs at the same time as the consumer enters into the open-end agreement the closed-end credit disclosures may be given at the time of conversion.

Closed-end credit may also include. Itemization of amount financed 102618c d. Closed-end credit is a loan agreement that requires borrowers to repay the loan in full by a specified date.

And 3The amount of credit extended during the term. Once the closed end credit is paid off and. Accordingly the disclosures required by 102618 apply only to closed-end consumer credit transactions that are.

Amount financed 102618b c. 2268 is the principal section for closed end credit disclosures. How Closed-End Credit Works.

The loan amount interest rate and loan term are agreed upon and both you and the lender must adhere to these terms. 102638 Content of disclosures for certain mortgage transactions Closing Disclosure. Identity of the creditor 102618a b.

The Credit Union will comply with the Truth-in-Lending Act and its implementing regulation Regulation Z by providing consumer borrowers with proper Truth-in-Lending disclosures for closed-end credit in a timely manner.

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

/GettyImages-1173647137-de07577da0184ccca8aef4d0a99e1768.jpg)

Understanding Closed End Credit Vs An Open Line Of Credit

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

What To Know About The Loan Estimate Closing Disclosure Cd

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Can I Get A Hud Florida Agency Network

Mandatory Disclosures To Consumer

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

New Mortgage Documents What Are They

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Understanding Finance Charges For Closed End Credit

Fdic Law Regulations Related Acts Consumer Financial Protection Bureau

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company